Last weeks tepid market action did little to change the larger picture for these stocks.

For Apple (AAPL), the stock appears destined to test the neckline of a head-and-shoulder pattern.

Vale S.A. (VALE) was able to briefly push through its 50-day MA before returning back to the key moving average on what amounted to a sizable bearish engulfing pattern (i.e. there is a good chance it won't stop at the 50-day MA for long).

On the flip side, Free McMoran (FCX) was able to comfortably hold its 50-day MA and continues to advance to its last reaction high at $61.25.

Barrick Gold (ABX) has managed to breach $54 on decent volume. The narrow trading of the past few days sets up a respectable long side opportunity with a stop on a loss of $53.50.

Baidu (BIDU) added to last weeks breakout and is attempting to build support at $135. However, stronger support looks to lurk at $130.

Cognizant Technology Solutions (CTSH) failed to push on from its narrow trading range. Instead it eased back towards $80 and may try and test $78. Selling action is low key with little volume behind it. This may represent complaceny, but given the strength of the multi-year advance it looks more like a buyers pullback.

Research in Motion (RIMM) is hanging on to its top-8 status. The stock has given up on its 200-day MA and is struggling to regain support from this important long term moving average. A move towards $44 from its current price of $54.80 would look favoured.

Finally, Intuitive Surgical In (ISRG) has done what is has long threatened to do and pushed sharply higher. The huge breakout gap was barely violated as the 200-day MA rose to offer a place for buyers to come in. This looks to be the start of something good for the long term.

Why not start your Zignals Trading Strategy Business with us today? Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

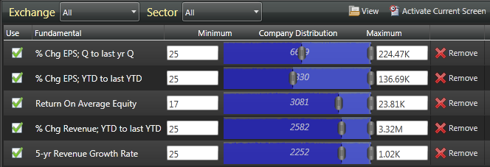

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.