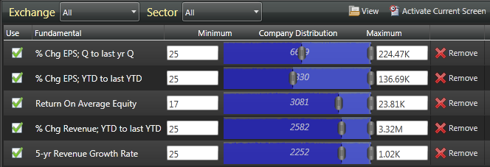

For another week there was no change at the top (ranked by Market Cap): Apple (AAPL), Vale S.A. (VALE), Free McMoran (FCX), Barrick Gold (ABX), Baidu (BIDU), Research in Motion (RIMM), Cognizant Technlogy (CTSH), and Intuitive Surgical (ISRG). The Screener setup was as follows:

Apple (AAPL) is looking very vulnerable at $330. Might not take much for it to test $325 which is where the tears will really start to flow if the latter price breaks. The head-and-shoulder projection is for a move to $285, altough there is a prior band of support between $295 and $300 which is a more likely target. [April 20th: Apple eventually dropped to test $320 in what looked to be a stop knockout and recovery. Still has work to do to hold $325 on the next fall with the 50-day MA lying overhead to offer supply. However, strong earnings look set to put any worry to bed and gives bulls an opportunity to turn the 50-day MA from resistance back to support].

Vale S.A. (VALE) is also showing what amount to the latter stages of a head-and-shoulder reversal. A break of $31 confirms and sets a target of $25, which is the congestion zone of last summer. [April 20th: Defended 200-day MA for a second time in the past couple of months. Converging 50-day and 200-day MA is squeezing long and shorts to a point where one side will break]

Free McMoran (FCX) having risen to challenge $58 has since headed South, slicing its 50-day MA with relative ease. The 200-day MA currently sitting just below $48 is a likely downside target. [April 20th: Toying with its 50-day MA having crossed above it yesterday - no firm direction]

Barrick Gold (ABX) has held its gains better than most. The 50-day MA at $51 offers a good place for stops if holding or looking to buy. Broader pattern is one of a consolidation, bound by $46 support and $55.50 resistance. [April 20th: Driving towards resistance on reasonable buying volume. Nicely primed for a break of $55.50; one to watch]

Baidu (BIDU) continues to fire on all cylinders. The rally is shaping to go parabolic, but hasn't exhibited the heavy volume typical of such a move. Suspect there will be a lot of stops just below $135. If prices were to break $135, watch for a spike low (i.e. rapid fall and equally rapid rise). Traders buying the stop-hits would be looking for a retest of whatever high the rally made prior to the break of $135. Nothing to suggest any of this will happen, but it makes for a good Alert. [April 20th: One of the few stocks to have a disappointing Wednesday. However, it's recent performance has outranked many on this list.]

Research in Motion (RIMM) keeps leaking price having lost 200-day MA support. Little to recommend it at the moment. [April 20th: Maybe buyers are trying to build support at $53, but it remains stuck under its 200-day MA at $56.39]

Cognizant Technology (CTSH) has enjoyed a solid rally, peppered with brief sallies below its 50-day MA. It looks likely to test the 50-day MA again early next week, but every test weakens it as support. Should the 50-day MA break then support kicks in at $72 and the 200-day MA just below $68. [April 20th: Pulls away from its 50-day MA, albeit on low volume. Time to consolidate its strong advance?]

Finally, Intuitive Surgical (ISRG) is consolidating its advance from $320 to $375. The stock looks to be shaping a cup-and-handle pattern with a neckine at $385. Could be one of the better stocks for the latter part of 2011. [April 20th: Buyers chased action elsewhere on Wednesday to the detriment of ISRG which saw some higher volume selling. Will sideline money wait for another test of the 50-day MA before jumping in?]

Find out more about Active Screening

Zignals Stock Screener from Declan Fallon on Vimeo.

Why not start your Zignals Trading Strategy Business with us today? Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.