How have these stocks reacted to prior selling?

Apple (AAPL) came off its 50-day MA in reasonable form. Recovery volume was a little light in the 3-day sequence of gains. But it was good enough to create a bear trap (bullish). However, Tuesday's sell off was worrisome as it makes the push to maintain the sequence of higher highs and higher lows harder. Should the 50-day MA be tested before a break of $363 occurs then the favoured outcome is for a larger push down to the 200-day MA, currently at $293.

New boy, Vale S.A. (VALE) and its $170B Market Cap, has been trading around its 50-day MA, but is in a no-mans land between 50-day and 200-day MAs and is currently fighting to hold $34 support. Bears will look to a possible bearish head-and-shoulder pattern as marked by the blue neckline in the chart below. The stock has the lowest P/E of the eight at 10.38.

Next in line is Barrick Gold (ABX). The past week have seen a continuation of the gains worked off its 200-day MA. Trades just below the 2011 reaction high of $54 and is on course to make a challenge of $55.40.

Free McMoran (FCX) is a good example of troubles stocks have trading between 50-day and 200-day MAs. With the 50-day MA rolling down the intermediate term is firmly negative. There is support at $48 to defend and a 200-day MA at $44.58 to provide additional help.

Baidu (BIDU) dug in at $114 support but is shaping a small bearish pennant just above this price level. With the 50-day MA rising to meet falling prices there is an opportunity for a bear trap - where prices break lower from the pennant but quickly recover to move higher.

Research in Motion (RIMM) as been slowly edging higher without fuss. The 50-day MA sits at $62.77 and is the nearest support level to look too.

Cognizant Technology Solutions Corp (CTSH) is trading around its 50-day MA, but it's getting squeezed by the rising 50-day MA and $76 resistance. Which will break first?

Finally, Intuitive Surgical (ISRG) has continued its move into space created by the huge breakout gap (below $320 and above $296). The 50-day MA at $304.98 is a probable buy point for sideline money. The scale of the gap suggests the push below $320 won't last long. Will the broader market help or hinder bulls?

Why not start your Zignals Trading Strategy Business with us today?

Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

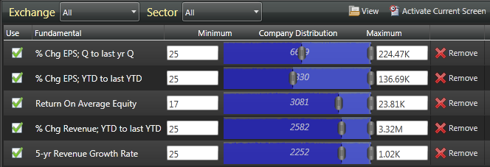

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!