Apple (AAPL) pushed a rally off head-and-shoulder neckline support, but it hasn't yet negated the bearish pattern. To do this, a rally past $363 (preferably on volume) is required. Strong earnings gives bulls the impetus to do this.

Vale S.A. (VALE) is still under the influence of its bearish head-and-shoulder pattern. An intraday reversal yesterday took the index away from resistance defined by the right-hand-shoulder high at $34.60. It's lingering close to its 50-day MA and looking vulnerable to another push lower.

Barrick Gold (ABX) is caught in a 50:50 make or break. The original break of $54 was undone by resistance at $55.50. This led to a rapid, heavy volume sell off back to triangle support. However, in doing so it took out its 50-day MA. Buyers will look to support as an opportunity, but the volume and rate of decline suggest there will be few takers if the stock drove through its 200-day MA.

Baidu (BIDU) was little changed on the last update. The rally continues its steady advance, going from $146 to $152.

Research in Motion (RIMM) has found a bid around $53.30, but there is work to do to regain its 200-day MA at $56.41. The large breakdown gap from late March (@$62.79) remains the dominating influence.

Cognizant Technology (CTSH) pulled away from its 50-day MA as part of a broad advance. It is currently negotiating $82.75 resistance which if successful will mean a new multi-year high for the stock. Bullish.

Netflix (NFLX) returned to the top-8 after a brief absence. Tuesday saw the stock drop towards its 50-day MA which has held as support in the past. Selling volume was heavy so there may be sufficient impetus to drive it lower. However, the 50-day MA has been key support in this multi-year rally so shouldn't be discounted easily.

Finally, F5 Networks (FFIV) makes a less than stellar return to this list. While the stock qualifies on a fundamental basis, its price is caught beneath 50-day and 200-day MAs. The stock gapped down big in January and has struggled to make any headway against the overhead supply generated by the selloff. One to watch for improvement, but it could be a while before it does.

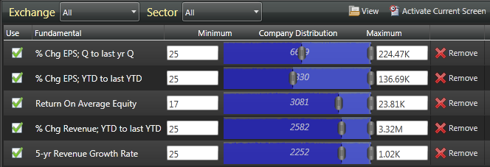

Find out more about Active Screening

Zignals Stock Screener from Declan Fallon on Vimeo.

-------------

Why not start your Zignals Trading Strategy Business with us today? Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.