Free McMoran (FCX) continues to ping around between $53 and $57.30. No reason to be a buyer or seller until one of these price levels break (and if to the upside, with volume).

Netflix (NFLX) is the real darling of the moment; $222 last week, $237 this week. Three days of sharp gains were followed by two days of light losses. Upside volume has been excellent since April. An easing back to $210 would give sideline money a chance to act, but given the momentum it might not venture too far below $220; rising support is there to offer an alternative entry.

What hasn't been said about Apple (AAPL)? It's still running inside its channel and doesn't look like slowing just yet.

Next we have Baidu (BIDU). Like Netflix it is also up sharply on the week, moving from $121 to $128. The rise has the makings of a 'pole' which should see a nice bull flag evolve - offering a low risk entry opportunity.

Research in Motion (RIMM) has managed to re-engage the rally. Clearing $66 and working itself towards $74. Could be a slow journey.

Cognizant Technology (CTSH) still hasn't cracked $76 with conviction. It trades at $76.64 but upside volume has been light and when trading heavier volume it has been to the downside.

Southwestern Energy (SWN) continues to struggle at $37. It lost its challenge to hold the $39 breakout and trading over the last week has taken the shape of a 'bear flag'; if true it could knock another $3 off the price and take out $35 reaction low support from December.

Finally, Intutitive Surgical (ISRG) has continued its advance from its massive gap breakout, albeit in much smaller steps. It currently trades at $339.99.

Why not start your Zignals Trading Strategy Business with us today? Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

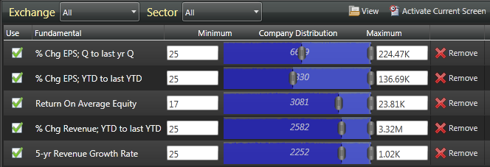

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!