This week, we see the return of Netflix (NFLX), this time at the expense of Celgene Corporation (CELG).

So how have these stocks fared?

Free McMoran (FCX) recovered from its loss of the 50-day MA, leaving behind a potential bear trap. If it can push above its 20-day MA it will be nicely positioned to challenge 2011 highs of $61.35. The stock split 2:1 today.

Netflix's (NFLX) return follows a sizable gap higher, taking it to new multi-year highs. The convergence of 20-day and 50-day MAs provided a good point of support and is likely to do again should the breakout gap fill.

Apple (AAPL) has been pressuring short term resistance around $345. Since the Steve Jobs health scare volume sell off the subsequent upside volume has been light. But if it can break above $345 it will only be $3 away from a new all-time high, which is likely to bring money back in from the sidelines.

Baidu (BIDU) gapped earlier this week to break above $115, but should bears make a return into the market then look for this to backfill towards $110 where it will offer value. Stops can go on a loss of $105. The previously stalled 50-day MA has started to push higher once more - ending the threat for a more prolonged decline.

Research in Motion (RIMM) failed in its initial cup-and-handle breakout and is currently trading at 50-day MA support. December saw a "Golden Cross" between 50-day and 200-day MAs which should mark a long term shift towards bulls. The failed cup-and-handle breakout has left wider resistance - going from c$64 to a thicker $64-66 range. However, while it trades at its 50-day MA there is good value with a stop on a loss of $58.

Cognizant Technology Solutions (CTSH) continued its rally after a successful test of its 50-day MA. So no change in the rally.

Southwestern Energy (SWN) hasn't quite got the kick I though it would. It is trading around $39 support but it hasn't yet acquired the mojo to push a test of $45.

Finally, Intuitive Surgical (ISRG), has done a great job in holding above $320 (the gap). I still think it will make a brief dip into the low $300s before continuing higher, but the fact it hasn't yet is a very bullish sign. Look for a challenge of $390 in the latter part of 2011.

So, one change to the list and a couple of stocks (BIDU and NFLX) trying to break from consolidations.

Why not start your Zignals Trading Strategy Business with us today?

Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

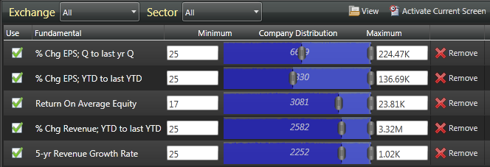

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!