The Zignals Trading Strategy Builder allows you cover the full story by allowing both short and long strategies. Because building a strategy is free you can create two strategies, one long - the other short, and trade the signals together. Because strategies are separate you can create one with a different exit strategy than the other, allowing you the flexibility to offer tighter stops in a short strategy when price collapses are frequently short and sharp, but loosen the reins and look for bigger profits (profit target) when trading the long side.

The only caveat with this format is the performance data of each strategy will only reflect the long or short side of the picture. The actual performance of this strategy traded side-by-side will be different.

For starters we will use the Nasdaq ($NASDAQ) and Russell 2000 ($RUT) as test indices. These two indices are compiled into a single stock-list I have called 'Indices' (i.e. this will be strategy where the signals will act on both indices).

For this article we will again be editing the Target&Stops so for a standard rule we will use the MACD crossover; the default 'MACD Signal Buy' rule for our long strategy and the default 'MACD Signal Sell' rule for our short strategy. While we will be making changes to our Targets&Stops in our Setup leave the default for now, but set the Delay between trades to zero. Don't forget to set the strategy type to 'Short' for the MACD sell rule and 'Long' for the MACD buy rule!

The backtest will run from November 12th 2008 to November 12th 2010.

As an initial test, running both strategies with the default Stop Condition generated the following results

Target: 15%; Stop: 10%; Trail employed; Target: 10%; Stop: 5%; Profit Target: 25%

1: Enters an average $9,125 per trade. Profit calculated from a $100,000 starting capital

Obviously, markets have had a bullish bias since the start of the backtest period so the long strategy will invariably outperform the short side.

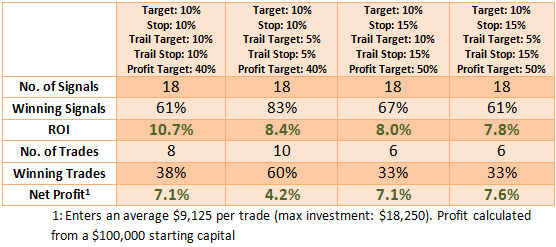

Starting with the long strategy and changing the Target &Stop conditions offered the following returns:

Not surprisingly, the broader the trail stop the fewer trades generated and the longer profits could be let run. On paper at least, building a strategy around the Target&Stop conditions used for the strategy returning 7.6% would appear the easy choice. But in real world trading the choice is rarely so clear, adhering to the signals is easier when the percentage of winning trades is up around 60%, rather than the 33% of the highest net returning strategy. The final choice is really a matter of personal preference and whether the psychology of frequent base hits is preferable to one relying on the home run.

Looking at the short side of the strategy, it was really a case of damage limitation.

Given our look back period has a dominant bullish bias running the aforementioned comparisons provide a false picture. Instead, how did our long and short strategies compare when pitted against a complete market cycle.

To do this the strategies were run from Jan 1st 2008 to Nov 11th 2010 (which offered a trading range, a sharp up and down, but effectively finished the period flat)

So for our meta strategy, we first looked at the following two systems:

LONG: Target 10%, Stop 10%, Trail Target 5%, Trail Stop: 5% and Profit Target of 40%

SHORT: Target 10%, Stop 15%, Trail Target 5%, Trail Stop 5% and Profit Target of 25%

So when the approach was to mix two strategies which each had a high percentage of winning trades the net return was barely positive; the aforementioned combo offered 56% winning trades (9 out of 16 trades) with a paltry 1.9% return. The problem occurred on the long side of the strategy as it held long, but got repeatedly stopped out in 2008, preventing us from taking the profitable signals on the short side.

If we switched out the Long strategy to:

LONG: Target 10%, Stop 10%, Trail Target 10%, Trail Stop: 10% and Profit Target of 40%

SHORT: Target 10%, Stop 15%, Trail Target 5%, Trail Stop 5% and Profit Target of 25%

Effectively matching a high % win short side strategy to a low % win long side strategy brought a dramatic improvement. The greater amount of wiggle room using a 10% Trail Target and Stop on the long side still left the win percentage at 57% from 14 trades, but it was able to ride longside plays for longer in 2009 despite staying on the wrong side in 2008. In effect, a $20,000 account which invested half of available capital up to a maximum of $10,000 per position finished with $26,563 or a 32% return (excl. commission) at the end of this period.

Detail of the Trades as follows

Why not create your own meta trading strategy, or FREE preVIEW existing strategies and see what you can create?

Why not start your Zignals Trading Strategy Business with us today? Learn How to promote your Zignals Trading Business with Twitter.

Follow us on twitter here

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com. JOIN US TODAY - IT'S FREE!