But first things first; FREE registration with Zignals followed by a prompt to download Microsoft's Silverlight will give access to the trading strategy builder. For this article I am working through the Zignals Dashboard which gives full access to all of our services (stock alerts, stock charts, stock screener and portfolio manager) within a single application. The key advantage of using this over the individual applications is the seamless switching between applications.

We shall start with a simple strategy - a price cross above a 20-day Simple Moving Average (SMA). This will be a long only strategy.

On loading the Trading System interface you will be greeted with a grid-interface; along the top is a set of menu options and on the right a series of steps, numbered 1 to 5, required to create a strategy. For the first step, select My Strategies.

This will open a window which defines the risk management and exit strategies. The first version of our trading strategy builder offers exits based on percentile steps; this is an excellent way of letting trades run as you can be as tight or as loose with the trailing stop/target as you want to be.

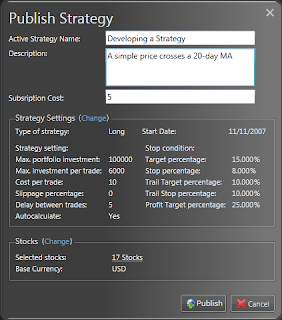

Default trading strategies start with $100,000 capital and an allocation of $10,000 per position. Checking the autocalculate option will preset the amount per trade based on the pool of stocks to draw from (so as to ensure you don't overinvest in situations triggers are given for all constituents). In this example we will be using 17 stocks which gives an allocation of $5,888 per trade; I have rounded this to $6,000 per position. The comission is set at $10 and have left the slippage percentage unchanged. The Delay Between Trades is used to control whipsaw and we have set this to 10.

The Stop Conditions offer more flexibility. There is the option to use or not use a trailing stop. To maximise profits we will use a trail; the trail kicks in once the initial Target Percentage is set - a position will be exited if prices fall by the Stop Percentage (in a long strategy). When the Target Percentage is hit then a rolling target and stop defined by the Trail Percentages is activated with an end point Profit Target which closes the position once reached.

Next it is time to assign your stocks. I have created a list using the same stocks of Active Trader: Apple (AAPL), Boeing (BA), Citigroup (C), Caterpillar (CAT), Cisco (CSCO), Disney (DIS), General Motors (GM), Hewlett Packard (HPQ), International Business Machine (IBM), Intel (INTC), International Paper (IP), J.P. Morgan (JPM), Coca Cola (KO), Microsoft (MSFT), Starbucks (SBUX), AT&T (T), and Wal-mart (WMT).

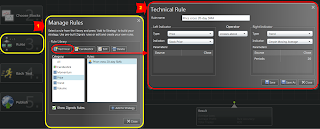

The most important step is to assign your rules. As this is a simple price crossing a moving average we will create a new Technical Rule. In the left-hand-dropdown we select Price and in the right-hand-dropdown we select Trend/Simple Moving Average with a period length of 20.

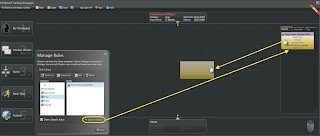

After a rule is created we need to Add to Strategy. This places the rule into a rule list on the right; from there it's a matter of dragging it into the workspace.

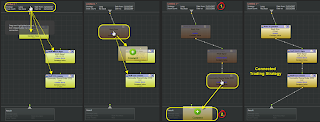

The first rule dragged-in will automatically connect to the starting point. Other rules you drag-in can either be connected to existing rules or, by dragging the top box down to the new rule, connect to the dragged-in rule (see below).

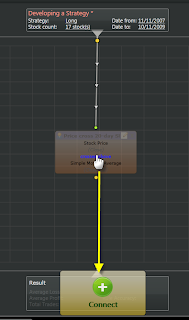

The final step is to connect your rule(s) to the end-point to complete the flow.

Once you are happy with your strategy it should then be saved.

From there we move to step 4 and define our back-test period. The default is the past 2-years but you test for any period back as far as 2001 (for US stocks). During a backtest an historical portfolio is created; if you wish to give this portfolio a name it can be done here. The option to view the portfolio is offered after the run is complete. This is recommended so you can see the performance of your strategy.

In the price cross of 20-day SMA with our trailing target/stop set at 10%/10% and profit target of 25% returned 17.2% over the past 2 years. Max drawdown was -23.4% but the srategy enjoyed a 44% win percentage. However, it did endure a maximum losing sequence of 13 trades which would hurt anyones confidence! The current portfolio holds 13 stocks.

At this point two options are available:

[1] The strategy can be edited further and new portfolios created OR

[2] The strategy can be Published so that the trading signals can be received by email.

To do this it is necessary to switch from the Portfolio Manager back to the Trading System. In the Trading System open your saved Strategy.

There is a full range of edits available including changing the risk management options - the stocks, Forex pairs, or commodities used - or the rules themselves.

When you are satisfied the last step, step 5, allows you to Publish the trading strategy to our MarketPlace. Publishing brings up a summary of your strategy and the conditions attached. A brief commentary can be attached and the subscription cost you would like to charge for when the MarketPlace comes out of Beta.

Publishing activates the mailing of signals. As the publisher of a strategy you will automatically be subscribed and will get trade signals delivered to your email box as they occur. Published strategies also appear in your Published Trading Strategies window.

If you would like to subscribe to this strategy - called Developing a Strategy - then you can do by searching for my user id ('fallond'), or any of the aforementioned stocks comprising the strategy, in the MarketPlace. Should the strategy perform well, then it will appear in the Top 20 Trading Strategies widget in the Dashboard.

If you have any issues or concerns, don't hesitate to contact me (declan-at-zignals.com); your queries could be the basis of my next blog post!

Follow us on twitter here

Dr. Declan Fallon, Senior Market Technician, Zignals.com. November 2009 has seen a significant upgrade to the site on the course to becoming the eBay of finance with our new Beta MarketPlace and a new rich internet application for finance, the Zignals Dashboard. Zignals now has new fundamental stock alerts, stock charts for Indian, Australian, Frankfurt and soon Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active fundamental system stock screener and trading system builder. New Forex and Index data.