In last week's article we looked at the structure of creating a simple Forex strategy, next we will look at applying some rules. We will review the initial Setup - we shall start with default settings which are more geared towards stock trading. We can change to Forex settings later.

Currency: US Dollar

Delay between trades: 0

Target Percentage: 15%

Stop Percentage: 10%

Use Trail

Trail Target Percentage: 10%

Trail Stop Percentage: 5%

Profit Target Percentage: 25%

Remember, the Forex strategy will invest fixed cash quantities and buy 'shares' but the signals are key.

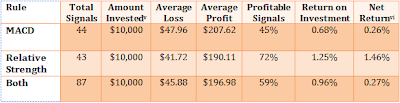

We will start with two rules; a trend rule which will be a MACD Signal Buy (one of the default rules) and a momentum rule, RSI (Relative Strength Index). Both the MACD and RSI are set at default values.

The MACD is built around the difference between two moving averages (12-day and 26-day), with a third moving average (the trigger line, 9-day) built off the difference between the two averages. When the MACD crosses the 9-day trigger line you get a signal. Moving averages are one of the most simplest trend measures indicators and work across all time frames, from intraday to annual. The Relative Strength Index is different as it measures the rate of change between average up and down closes over the past 14-days (default) and converts it to an oscillator bound by 0 and 100. Values above 70 represent an overbought ('hot') market, values below 30 represent an oversold ('cold') market. A MACD has no fixed boundaries. When the RSI crosses above 30 you get a signal trigger.

First we will look to individual rule performance. Remember, when connecting rules there has to be a flow from top to bottom; when your strategy is set correctly the borders around the rules will stop flashing red.

The Back Test period is from 21st October 2008 to 21st October 2010.

When we have our Rules connected and our Back Test run the performance of our preliminary strategy will be given in the Result box. We can also view a Portfolio to see how the Strategy would have performed in practice. Differences between Total Signals in the Result box to Number of Trades in the Portfolio is because new signals for currently held positions are ignored (i.e. there would be no doubling of an existing position).

On initial inspection, it looks like the Relative Strength rule should have had a significant performance advantage over the MACD rule. But digging into the details of the two strategies, the MACD strategy saw 12 trades from 44 signals (58% winners), while the RSI strategy had only 7 trades from 43 signals (71% winners); the larger number of winning trades in the MACD strategy compensated for the lower win percentage.

If we place the two rules together, side-by-side, where a position is taken IF either condition is true, then the following returns are obtained:

In the dual rule scenario, the strategy was able to maximise the best of two worlds. From the 87 signals there were 10 profitable trades, 70% of which were profitable. So under the default Target&Stop condition there was a clear advantage of using the two rules together. Unfortunately, using this in practice this would leave you exposed to huge pip losses. Just as an example: a EURUSD trade bought on February 9th at $1.3673 was stopped out on May 17th at $1.2281, a 1,392 pip loss!

What if we changed the Target&Stop to something more geared towards a Forex trader.

Target Percentage: 1%

Stop Percentage: 0.5%

Use Trail

Trail Target Percentage: 1%

Trail Stop Percentage: 1%

Profit Target Percentage: 5%

So when the risk management is narrowed to a much tighter target and stop, the benefit of having the dual trend and oscillator rule was lost. Different rule combinations will have varying behaviours under different risk management conditions.

In the case of the strategy built using the best performing Relative Strength indicator, there were 31 trades from the 43 signals, 55% of which were profitable. To give the returns better context in a Pip scale. The most recent trade for EURUSD was a buy on June 8th at $1.1940 and a sell on June 15th at $1.2147, a 207 pip or 1.61% gain. The largest loss for the strategy was a GBPUSD trade bought at $1.4387 on May 21st and stopped out four days later at $1.4286 for a 101 pip or 0.82% loss. The largest gain was a AUDUSD trade bought October 28th at $0.6037 and sold on October 29th at $0.6425 for a 388 pip or 6.31% gain.

When all trades for the strategy were considered, the average return was +1.42%.

We will come back to rules and trying different combinations in later articles, but this will give you a grounding to start using your own rule combinations.

[i] Non-leveraged investment. $10,000 = $100 Forex trade

[ii] Two-Years Return; note - Net Return ignores signal triggers for existing positions.

Follow us on twitter here How to Get Started with Zignals

Build a trading strategy in Zignals and potentially earn money too; download our Build a Trading Strategy PDF and get selling (and trading) today!

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies via his Zignals home page. Each Zignals member has an unique home page which they can share with friends and clients to sell their strategies.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too.

Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com. JOIN US TODAY - IT'S FREE!